About Final Expense of America

Las Vegas, NV, USA

In the bustling market of final expense insurance, Final Expense of America emerges as a notable option for those seeking financial security for their end-of-life expenditures. This company distinguishes itself by offering a suite of insurance products designed with simplicity and affordability in mind, catering to the needs of seniors who wish to spare their families from the financial burden associated with their passing.

One of the company's standout features is its no medical exam policy, which underscores its commitment to accessibility. This aspect is particularly appealing to those who may face challenges obtaining insurance due to health concerns. Final Expense of America recognizes that the process of qualifying for insurance can be daunting, and they have streamlined it to ensure that more people can easily secure coverage without the hassle of medical screenings. This could be a determining factor for customers who value convenience and speed in their insurance procurement process.

Additionally, the company's Funeral Concierge Program is a thoughtful service that offers a compassionate touch during trying times. By guiding families through the complexities of funeral arrangements, the program provides emotional and logistical support that is invaluable during periods of grief. This unique offering not only demonstrates the company's understanding of its clients' needs but also its dedication to service beyond the policy.

Final Expense of America also prides itself on its transparent benefits, such as locked-in premium rates and guaranteed benefits that won't decrease over time. These features provide a sense of reliability and predictability for policyholders, ensuring that their coverage remains consistent and dependable throughout their lives. This stability is essential for anyone looking to secure their financial legacy with clear and unwavering terms.

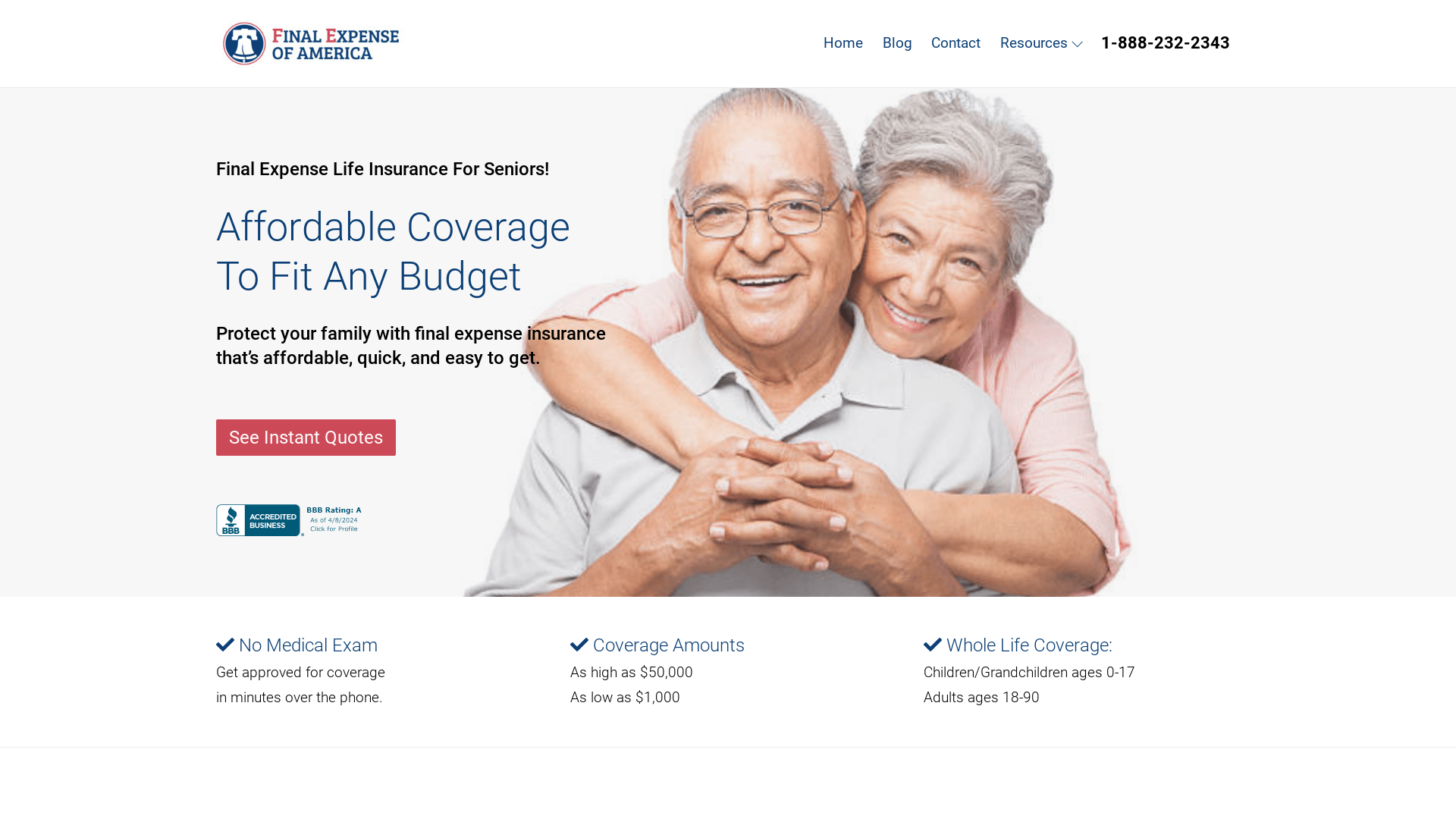

The company's digital presence, through its straightforward and informative website, offers potential clients a seamless online experience. The site provides instant quotes and a wealth of resources to educate visitors on final expense insurance, its importance, and the factors to consider when choosing a policy. This educational approach empowers consumers to make informed decisions tailored to their specific circumstances.

While Final Expense of America offers a robust selection of services, it is important for customers to assess their individual needs and compare the market thoroughly. No service is without its limitations, and what works for one may not suit another. Potential clients should consider factors like coverage amounts, the scope of the policies, and the company's partnership with top-rated carriers to determine if Final Expense of America is the best fit for their final expense insurance needs.

In conclusion, Final Expense of America's commitment to no-hassle policies, compassionate customer service, and educational resources positions it as a compelling choice in the final expense insurance sphere. Its client-centric approach, combined with the practicality of its insurance offerings, makes it worthy of consideration for those seeking peace of mind in their later years.

Fast Facts

- Final Expense of America offers immediate coverage options with no medical exams required.

- Coverage amounts offered range from as low as $1,000 to as high as $50,000.

- Final Expense of America provides whole life insurance policies for children and grandchildren from ages 0-17 and for adults from ages 18-90.

- Policies are designed with premiums that never increase and benefits that never decrease.

- Final Expense of America's policies build cash value over time that policyholders can borrow money from.

- The company offers a Funeral Concierge Program which includes personalized service and discounted prices for members.

- Final Expense of America partners with top-rated insurance carriers such as Mutual of Omaha, Liberty Bankers, American Amicable, AIG, and SBLI.

Products and Services

- Final Expense Life Insurance - A whole life insurance policy with affordable premiums designed to cover end-of-life expenses such as funeral costs, medical bills, and legal fees without requiring a medical exam.

- Funeral Concierge Program - A service that provides step-by-step guidance to families throughout the funeral process, offering personalized support, discounted pricing, and a global funeral network.

- No Medical Exam Coverage - Insurance policies that offer immediate approval over the phone, without the need for a medical examination, simplifying the application process.

- Whole Life Coverage for Children/Grandchildren - Insurance coverage options for children and grandchildren ranging from ages 0-17, providing long-term financial protection.

Want to learn more?

Click here to check out the rest of our rankings and reviews.