-

Definitive Rankings

We work hard to come up with definitive, objective rankings. Learn more about our rankings

-

Superlative Quality

Only the top companies are ranked on our lists. Learn more about our standards

-

Objective Metrics

We use a set of advanced metrics to gauge each company. Learn more about our metrics:

Ranking: Best Final Expense Insurance Companies

Explore our expert rankings to find your ideal partner in the final expense insurance companies industry.

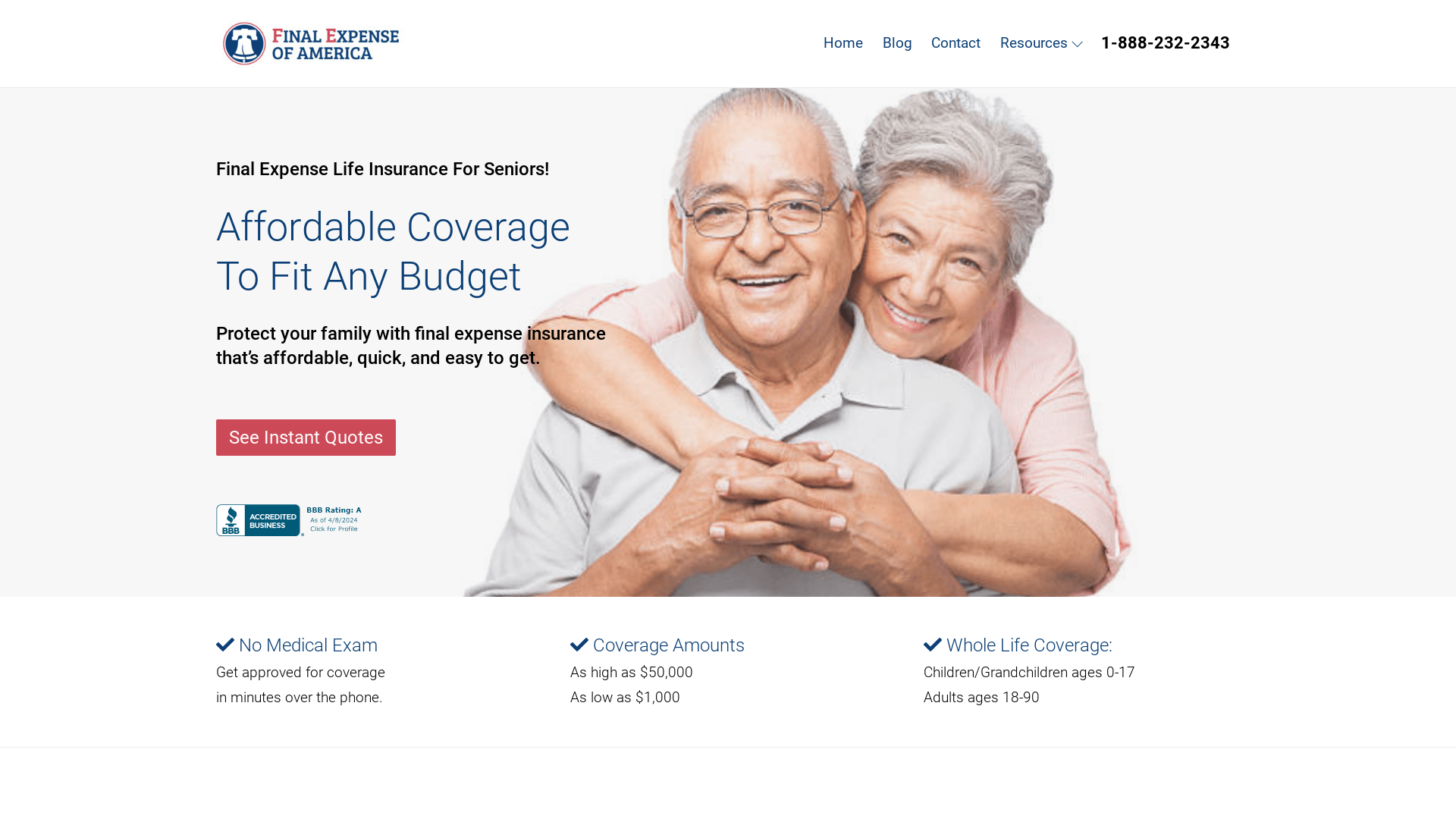

#1

Final Expense of America

Las Vegas, NV, USA

Final Expense of America is a customer-centric insurance company that offers specialized final expense insurance services to seniors. The company stands out with its flexible coverage amounts, ranging from as low as $1,000 to as high as $50,000, without necessitating any medical exam. It partners with top-rated insurance carriers like Mutual of Omaha and AIG to provide optimal value to its customers. An additional standout feature is their unique Funeral Concierge Program, which provides a comprehensive support system for families during the funeral process, including discounted services and global support. For those grappling with the financial and emotional toll of end-of-life expenses, Final Expense of America presents an affordable and accessible solution.

#2

United Heritage Life Insurance Company

Meridian, ID, USA

United Heritage Life Insurance Company is a reliable and reputable name in the US insurance industry, offering a range of products suited for various life stages. Notably, their final expense insurance provides a financial safety net for funeral and burial costs, which is a thoughtful offering in times of emotional distress. With a focus on corporate responsibility and community wellbeing, United Heritage also stands out for its ethical stance. The company’s A- rating from both Kroll Bond Rating Agency and AM Best underlines its solid financial strength. Backed by a network of independent agents and funeral home professionals, United Heritage facilitates personalized service, demonstrating a commitment to customer comfort and satisfaction.

#3

Final Expense Brokerage

North Canton, OH, USA

Final Expense Brokerage (FEB) is a comprehensive platform that connects Independent Life and Senior Health agents with an extensive range of life and health insurance companies in the US. With an impressive roster of insurance providers such as American Amicable, CVS/Accendo, Gerber Life, and Mutual of Omaha, FEB is committed to enhancing the success of their agents by offering high commissions and versatile lead and bonus programs. To assist agents in their business, FEB provides a variety of products from Final Expense and Term to Annuities and Medicare Supplement. They also provide valuable tools such as the Final Expense Rate Comparison Tool and the FEB $200 Lead Co-Op Program. Based in North Canton, Ohio, Final Expense Brokerage positions itself as a valuable partner in guiding agents on their journey to success.

#4

Heartland Retirement Group

Johnston, IA, USA

Heartland Retirement Group (HRG) emerges as a key player in the field of final expense insurance in the U.S. Their approach is refreshingly client-centric, educating customers while offering a broad range of insurance options. With partnerships with over 150 insurance companies, HRG ensures their clients' needs are met with the best possible solutions. They've served over 28,000 customers since their inception in 2010, demonstrating their experience and commitment to their clients' needs. Their breadth of services, including post-hospital coverage, Medicare solutions, and retirement strategies, suggest a holistic approach to retirement planning. HRG's multiple branch locations across the nation ensure easy accessibility for their clients.

#5

Pinnacle Financial Services

Warminster, PA, USA

Pinnacle Financial Services, based in Warminster, Pennsylvania, is an established authority within the final expense insurance market. Providing a wealth of services for both agents and clients, the company is dedicated to equipping agents with top-tier tools and resources to streamline sales processes. The firm's commitment to technology and education sets it apart, with offerings like online enrollment systems, a comprehensive Medicare toolkit, and a diverse selection of webinars. Pinnacle also prioritizes community involvement and has a strong social media presence. This company's well-rounded approach to final expense insurance makes it a notable player in the industry.

#6

ConsumerCoverage

Katy, TX, USA

ConsumerCoverage, based in Katy, Texas, has established itself as a robust one-stop solution for diverse insurance requirements. With a broad spectrum of offerings including home, auto, life, health, motorcycle, and Medicare insurance, it astutely caters to a wide range of customer needs. The company prides itself on its commitment to financial literacy, helping clients make informed decisions. It distinguishes itself through its customer-oriented approach, boasting a 99% satisfaction rate and partnerships with over 100 top insurance carriers. Not only does ConsumerCoverage offer insurance services, but it also provides insightful financial guides, articles, and videos, underscoring its dedication to empowering its customers. Its innovative measures in promoting green initiatives also reflect a commendable sense of corporate responsibility.

#7

Columbian Financial Group

Binghamton, NY, USA

Columbian Financial Group, a veteran in the insurance industry for over 140 years, is a comprehensive suite of insurance solutions, including the noteworthy Dignified Choice® Final Expense. Based in Binghamton, NY, the company's robust team of 300 plus associates operates across various locations, supporting an impressive network of over 20,000 independent agents nationwide. The company's portfolio of offerings also includes innovative products like Life's Solutions Whole Life and SafeShield® Simplified Issue Term. Columbian Financial Group distinguishes itself by its commitment to customer service, with resources such as policy service requests and a plethora of consumer education materials. With a keen focus on accessibility and consumer protection, it emerges as a reliable choice for insurance needs in the US.

#8

Liberty Bankers Insurance Group

Dallas, TX, USA

Liberty Bankers Insurance Group, a Texas-based financial services firm, stands out among American final expense insurance companies for its comprehensive approach to financial well-being. The company's product suite extends beyond final expense insurance to include retirement annuities and supplemental health coverage, offering a holistic solution for consumers' financial needs. Liberty Bankers also prioritizes community involvement and client service, underscored by their initiative of giving back and a 60-year history of client satisfaction. Furthermore, the company's recent launch of Summit Prime Fixed Indexed Annuities demonstrates its commitment to innovative product offerings. Overall, Liberty Bankers Insurance Group presents a compelling blend of financial acumen, client service, and community involvement.

#9

eFinancial

Bellevue, WA, USA

In the bustling world of final expense insurance, eFinancial emerges as a shining star, earning a spot among the best final expense insurance companies in the US. This firm, with an impressive digital footprint, shows a knack for blending modern technology with traditional customer service. The result? A user-friendly platform that makes securing insurance as simple as ordering takeout. eFinancial proves that insurance doesn't have to be complicated or dreary - it can be a smooth, stress-free process that leaves customers feeling secure and valued. This company certainly doesn't play small in this big league, making it a worthy contender in our top 10 list.

#10

Prosperity Life Group

New York, NY, USA

Prosperity Life Group, a U.S.-based firm, stands out in the competitive landscape of final expense insurance companies. With over a century of experience in life insurance, the firm has cultivated a trusted reputation, managing an impressive $16.1 billion in assets. Their portfolio extends beyond insurance, delving into reinsurance and innovative asset management. Prosperity Life Group showcases a strong financial backbone, boasting an 'A-' rating from both AM Best and Kroll. Their focus on customer-centricity is evident, with a wide array of insurance products tailored to individual needs. This company is a distinguished player in the market, ensuring financial security for their customers and their families.

Our Mission

At Best Final Expense Insurance Companies, our mission is to provide a comprehensive, unbiased ranking of final expense insurance companies in the United States. We strive to help consumers make informed decisions about their final expense insurance options by offering meticulously researched, up-to-date information. Our commitment to accuracy and transparency ensures that every ranking is based on a thorough understanding of the insurance landscape, empowering individuals to choose the best possible coverage for their unique circumstances.

Are final expense insurance companies worth it?

Final expense insurance companies provide a valuable service by ensuring that your end-of-life costs are taken care of, alleviating financial burdens for your loved ones. Their expertise in navigating the complexities of funeral expenses can offer peace of mind and a sense of security for you and your family. Considering the potential benefits and the reassurance it can bring, hiring a final expense insurance company may indeed be a wise decision.

What to look for when hiring final expense insurance companies?

At Best Final Expense Insurance Companies, we understand that navigating the landscape of final expense insurance can be a complex task, often fraught with mystifying terminology and multifaceted decisions. To help demystify this process, we've created an extensive list of frequently asked questions (FAQs). Our goal is to equip you with the vital information you need, illuminating any areas of uncertainty and providing clarity for your essential queries. These FAQs serve as a guiding light, offering succinct, precise and straightforward answers to common questions about final expense insurance companies, thus fostering a more informed decision-making process.

What is the financial stability and reputation of the insurance company?

The financial stability and reputation of a final expense insurance company are key factors to consider when choosing a provider. Financial stability is essential as it indicates the company's ability to meet its financial obligations, including paying out claims. You can assess this by looking at financial ratings from independent agencies like A.M. Best or Standard & Poor's. A company with a high rating is generally considered financially stable. Reputation, on the other hand, is a reflection of the company's track record in treating its policyholders. You can gauge this by reading customer reviews and checking for any complaints lodged with the state insurance department or the Better Business Bureau. A company with a good reputation will have positive reviews and fewer complaints. Comparing these aspects across different final expense insurance companies can provide a clearer picture of the best options available. Remember, a decision should not solely be based on cost, but also on the company's financial stability and reputation to ensure you are entrusting your final expenses to a reliable provider.

Does the policy offered by the company meet my specific needs and budget?

Determining whether a policy offered by a final expense insurance company meets your specific needs and budget involves a thorough examination of several factors related to your personal circumstances and the specific offerings of the company. Start by identifying your personal needs and budgetary constraints. Once these are clear, you can compare them against the coverage, terms, and costs of policies offered by various companies. While reviewing these policies, pay close attention to aspects such as the death benefits, premium rates, policy exclusions, waiting periods, and whether the policy is term or whole life. It's also important to consider the company's reputation, customer service, and the ease of the claims process. Remember, the best policy for you is one that provides the coverage you need at a price you can afford, from a reputable company. It's advisable to review several options before making a decision. In this way, you can ensure you're making an informed choice about your final expense insurance.

Does the company offer good customer service, including easy claim process and prompt response?

Good customer service, including an easy claim process and prompt response, is a crucial factor when considering final expense insurance companies. The quality of customer service can greatly impact the overall experience, especially during such a sensitive time. When evaluating different companies, it's worth researching their track record regarding claim processing and response times. Some companies may offer online claim filing, 24/7 customer support, and dedicated agents to enhance their service quality. Reading customer reviews and ratings can also provide valuable insights into the company's customer service performance. Additionally, examining the company's response to any negative reviews can give an indication of their commitment to customer satisfaction. Therefore, while considering final expense insurance companies, ensure to take into account their quality of customer service, promptness in response, and efficiency in claim processing.

Key takeaways about final expense insurance companies

When considering final expense insurance providers, it's crucial to assess their financial stability. Look for companies with strong credit ratings and a history of financial strength to ensure they can fulfill their obligations. Additionally, evaluating their policy offerings is essential. Opt for a provider that offers flexible coverage options tailored to your needs, with transparent terms and conditions. Customer service is another key factor to consider. Seek out companies with a reputation for responsive and helpful customer support to provide peace of mind during the claims process. Lastly, reviewing customer feedback and ratings can offer valuable insights into the overall satisfaction and reliability of the insurance company.

Frequently Asked Questions

Final expense insurance policies can be a strategic financial tool to manage your end-of-life expenses. These policies alleviate the financial burden on your loved ones by covering funeral costs, outstanding medical bills, or other debts you may leave behind.

As you compare options, consider factors like monthly premium costs, policy terms, and reputation of insurance companies to make an informed decision.

Yes, there are two primary types of final expense insurance policies: standard and pre-need.

Standard policies allow policyholders to allocate funds to beneficiaries who can use the death benefit for any purpose.

Pre-need policies, on the other hand, are directly linked to a funeral service provider and cover specific funeral expenses.

Each type has its own advantages and considerations, so it's crucial to understand both before making a decision.

Final expense insurance policies generally tend to be more affordable than traditional life insurance plans. This is mainly because final expense insurance covers only end-of-life costs such as funeral expenses, while traditional life insurance offers a larger death benefit meant to replace income or cover significant expenses like mortgages.

However, the exact cost comparison can vary widely based on factors like age, health status and policy specifics. It's essential to compare multiple companies and policies to ensure the best fit for your unique needs and budget.

Several factors can influence the cost of a final expense insurance policy. Primarily, your age, health status, and the policy's coverage amount play a significant role. Insurance companies may charge higher premiums for older individuals or those with pre-existing medical conditions. Additionally, a policy with a higher coverage amount will typically cost more. It's crucial to compare different insurers to find a policy that provides adequate coverage at an affordable price.

Absolutely, both your age and health status can impact your eligibility for final expense insurance. Generally, older individuals or those with severe health conditions may face higher premiums or be denied coverage.

However, some companies offer guaranteed issue policies, which don't require a medical exam. It's crucial to compare different providers to find a policy that suits your specific circumstances.

Yes, you can purchase a final expense insurance policy for a family member. These policies, provided by companies specializing in end-of-life expenses, are designed to cover costs such as funeral services, medical bills, or other debts.

When comparing options, consider factors like premium rates, coverage amounts, and company reputation. Remember, obtaining a policy for someone else usually requires their knowledge and consent.

Benefits from a final expense insurance policy are paid out upon death to the designated beneficiary. This payout, also known as a death benefit, is typically issued in a lump sum and is generally tax-free. The beneficiary can use these funds to cover funeral costs, outstanding debts, or any other expenses as they see fit. The exact payout process can vary slightly between insurance companies, so it's crucial to understand the specifics of your policy.

Final expense insurance companies generally do not impose restrictions on how the policy payouts can be utilized. The beneficiaries have the flexibility to use the funds as they see fit, whether for funeral expenses, medical bills, legal costs, or even personal use.

However, it's essential to note that the specifics may vary depending on the individual policy and insurance provider. Always review the terms of any policy before making a decision.

If you miss a payment on your final expense insurance policy, typically, the insurance company will provide a grace period - usually 30 days - to make the payment without your policy being cancelled.

However, if you do not make the payment within the grace period, your policy may be cancelled, leaving you without coverage.

It's crucial to understand individual company policies, as some may offer reinstatement options under certain conditions.

Yes, you can cancel your final expense insurance policy if you change your mind. However, it's important to understand that terms and conditions will vary by company.

Some companies may offer a "free look" period where you can cancel without penalty, while others may charge a cancellation fee. Always read your policy carefully and consult with your insurance provider to understand your options.

Premiums for final expense insurance policies are typically fixed and do not increase over time. This is one of the main benefits of this type of insurance, as it provides consistent and predictable costs for policyholders.

However, it's important to thoroughly review the terms and conditions of any policy, as some companies may have different structures or exceptions.

Final expense insurance companies typically do not require a medical exam for policy approval. This is due to the nature of the coverage, designed to provide funds for end-of-life costs, making it more accessible to those in poor health or advanced age.

However, some companies may ask health-related questions during the application process to assess risk levels. Always compare companies and their policies to find the most suitable option for your circumstances.

Are you interested in being evaluated for next year's list?

Contact Us